Skid Steer And Attachment Financing

Share

Finance Your Skid Steer Attachments With

Skid Steers Direct

Skid Steer attachments are expensive. Not every business or operator has the cash to purchase new or used equipment when needed. With our finance partner CIT Small Business Solutions, Skid Steers Direct is thrilled to offer some of the best equipment financing plans.

In these uncertain economic times, people want a nest egg. Savings take time, and generating the revenue you need first is challenging without the right gear.

Our financing products take advantage of Section 179 of the IRS tax code to offer low to no money down skid steer financing with an easy and accessible payment plan. This is a unique financing program that we have put work into to deliver a unique credit product for equipment buyers.

How To Apply For Financing

- Each product and blog page has an orange link to our financing application page.

- Fill in your basic business information.

- Get instantly approved for up to $250,000 in financing.

- Our sales team will contact you to create a purchase order for your equipment.

- Our lending manager will provide you with several different loan terms.

- Once you have agreed on terms and digitally signed the contract, you are all done! We will now process your order.

Click The Link Below To See Your Pre-approval Amount With No Obligation

How To Save Money By Financing Skid Steer Attachments

[Consult your accountant for a complete understanding]

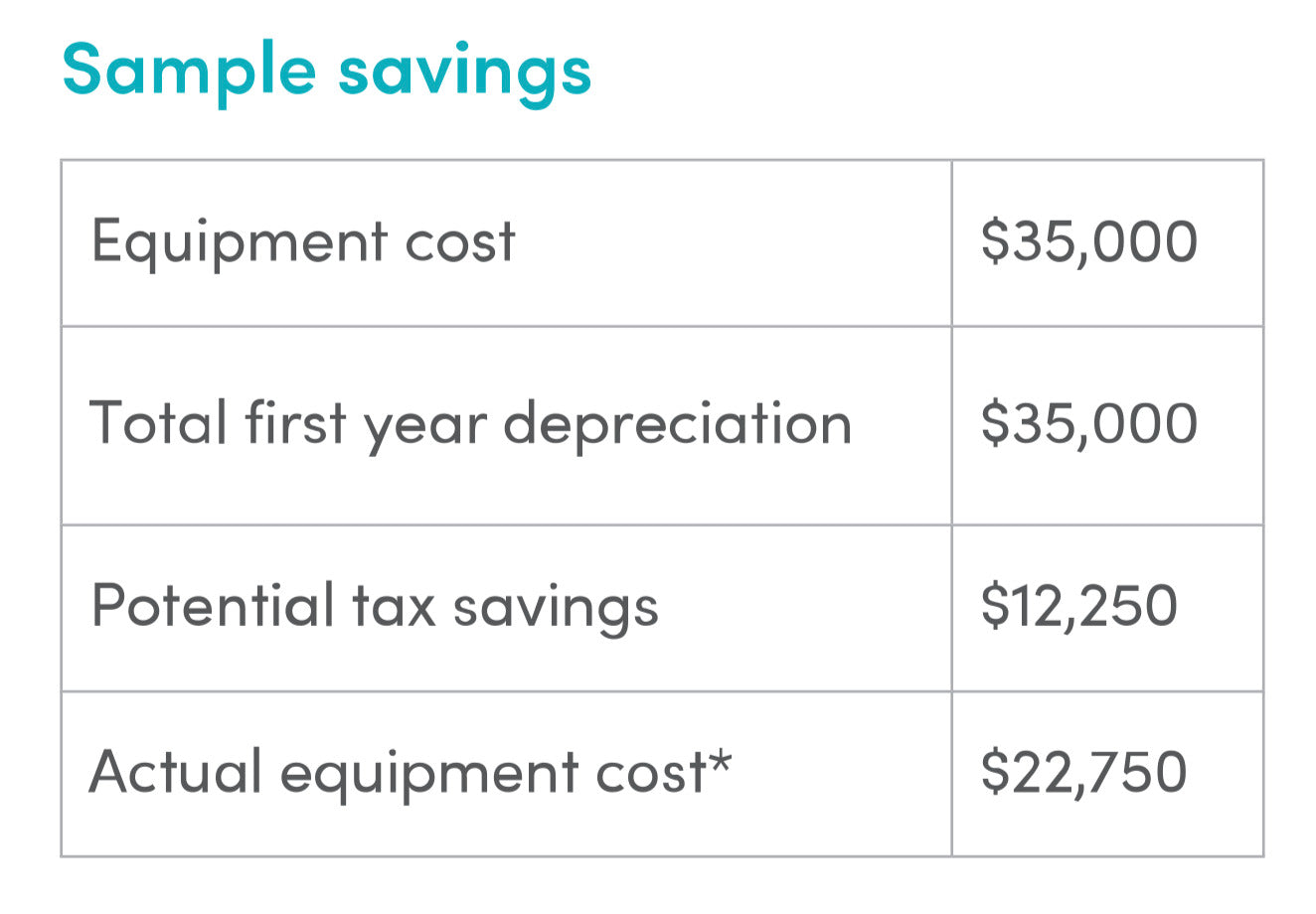

Section 179 of the IRS tax code lets businesses deduct the total purchase price of qualifying equipment financed during the tax year up to $1,080,000. Bonus depreciation is also available to those who purchase over $2,700,000 in qualifying equipment!

Simply put, if you purchase a skid steer attachment, you may be able to fully depreciate it immediately on delivery. This depreciation can lower your tax bill, which results in overall savings on the attachment.

If you finance this fully depreciated attachment, you save money now and pay for the equipment later, as you use it to make money!

Example

1) Purchase a new piece of equipment and begin using it before December 31st of this year

2) Accept full dedication of equipment depreciation up front rather than over several years

3) Save money NOW on your bottom line

More Benefits Of Financing Your Equipment

Fast Application and Approval

With no money down financing plans, start generating revenue with your skid steer or attachment immediately, making payments as you go. Our quick and convenient online application portal gets you credit today without losing critical productive time spent saving or risking your hard-earned reserves.

Attachment Payments Are Taxed Favourably

Financed equipment can be dedicated as an operating expense in the period in which it's paid, which reduces the overall cost. Payments are also treated as expenses on the income sheet, so there's no need to worry about depreciation.

Pay as you Go

Making monthly payments as you go keeps your cash in your pocket and allows the equipment to pay for itself as it generates revenue for your business.

Competitive Rates

Find out what your monthly payments would be with our rate calculator. Finance your attachments with our fast and convenient application portal, or contact our loan partner James Kelley with CIT, for more information.

https://skidsteersdirect.directcapital.com/

Frequently Asked Questions

What kind of credit do I need?

We offer a variety of rates and options depending on your credit score.

How long does the approval process take?

Typical turnaround time is only 2-3 days, compared to 2-3 weeks at many financial institutions and credit unions.

What does a typical repayment period look like?

Terms between 6-72 months are available. Most customers choose 38 monthly loan payments.

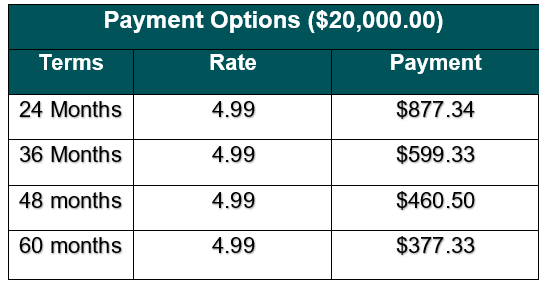

What will my monthly payment be?

Payments will depend on the size of your loan, but our rates will be comparable across terms. The application portal will help you see what the best financing options are for you. See below a helpful calculator chart on a sample $20,000 loan. As you can see, our financing plans deliver good deals at fair and lower rates.

What kind of information do I need to provide?

Many applicants receive pre-approval automatically with no documentation required, especially for loans under $250,000.

Can I get financing to buy through vendors other than Skid Steers Direct?

Yes, you can. While we'd prefer to have your business, you can access credit through the "Skid Steers Direct Capital" application portal and then take your loan to the supplier of your choice. The loan can also be used at multiple vendors and supplemented with cash upfront.

Can I purchase more than one piece of equipment with this loan?

Yes! Many customers have even used this financing program to get attachments and equipment from more than one vendor. One customer obtained financing through our Skid Steers Direct financing partner, purchased from one of our competitors, and then utilized leftover funds to buy an additional $250,000 with us, paying cash on the difference between their remaining credit and the purchase price. The unique process and lending relationship allow us to keep the same rates regardless of where the customer is purchasing from

How much credit am I eligible for?

The full purchase price of up to $1,080,000 is available in equipment financing through CIT and Skid Steers Direct.

Who Provides the Loan?

Our unique skid steer financing products are offered through our partner CIT First Citizens Bank and Trust Company.

How are you offering no money down?

These loans are made possible by customers accepting full dedication of equipment depreciation up front rather than over several years and taking advantage of Section 179 of the IRS tax code. This makes the economics work for the lender and allows you to pay less taxes. Preforfeiting the depreciation, which would happen anyways over the machine's service life in your care, isn't much of a sacrifice!

Additional helpful information

- True Commercial Loan = Debt is reported to the customer's business exclusively.

- Financing from $2,000 - $500,000 APP only

- No penalty for paying off early

- Financing for EQUIPMENT + SOFT COSTS (tax, shipping, installation, etc.).

- Rates are typically aligned with consumer mortgages.

Where can I get more information?

CIT Representative James Kelly is available for you to contact by phone or e-mail to provide any information and help you with any questions:

james.kelley2@cit.com

(603) 373-1390

How do I apply?

Skid Steers Direct online equipment financing portal "Direct Capital". Click the link or find it on our website when browsing our extensive selection of the best brand and helpful advice. We have the best options, from credit to equipment, to get equipment to work for you now. (https://skidsteersdirect.directcapital.com/)

Testimonials

Derek Dicks, Equipment financing business customer. [prosource machinery]

“Although CIT handles the transaction from start to finish, I never feel like I lose control of the transaction. I am informed throughout the process and never left in the dark about a transaction. It is seamless,”

“My favourite thing about CIT is that they’ll answer the phone and tell me where we’re at in the process. That sounds a little bit basic, but believe me, there are people out there that don’t do that,”

“I would definitely point other IEDA members to CIT; We know the process works with CIT. They have been a great ally for us to help get our customers financed.”

Paul Lashin Equipment financing business customer [Prestige Equipment]

“You have to move much faster, be nimble, and offer more options,” said Lashin of today’s equipment market. Financing is a facet of the business which I believe is very helpful in giving someone the extra edge to make a deal.”

“CIT is very quick to respond and takes a hands-on approach. If they’re working the financing end of the deal, we aren’t concerned that our customer is going to get lost in the shuffle or fall through the cracks,”

“It’s important to note,” he continued, “that although what we do is buy and sell iron, our business is really a people business. Having the right relationships with people you can trust is imperative if you’re to have long-term success in our industry.”

“We know we can trust CIT, and you know we really consider them family in a sense... and I mean that sincerely.”